Trend Status Update

- Marc Bentin

- Apr 1, 2019

- 4 min read

Last quarter...

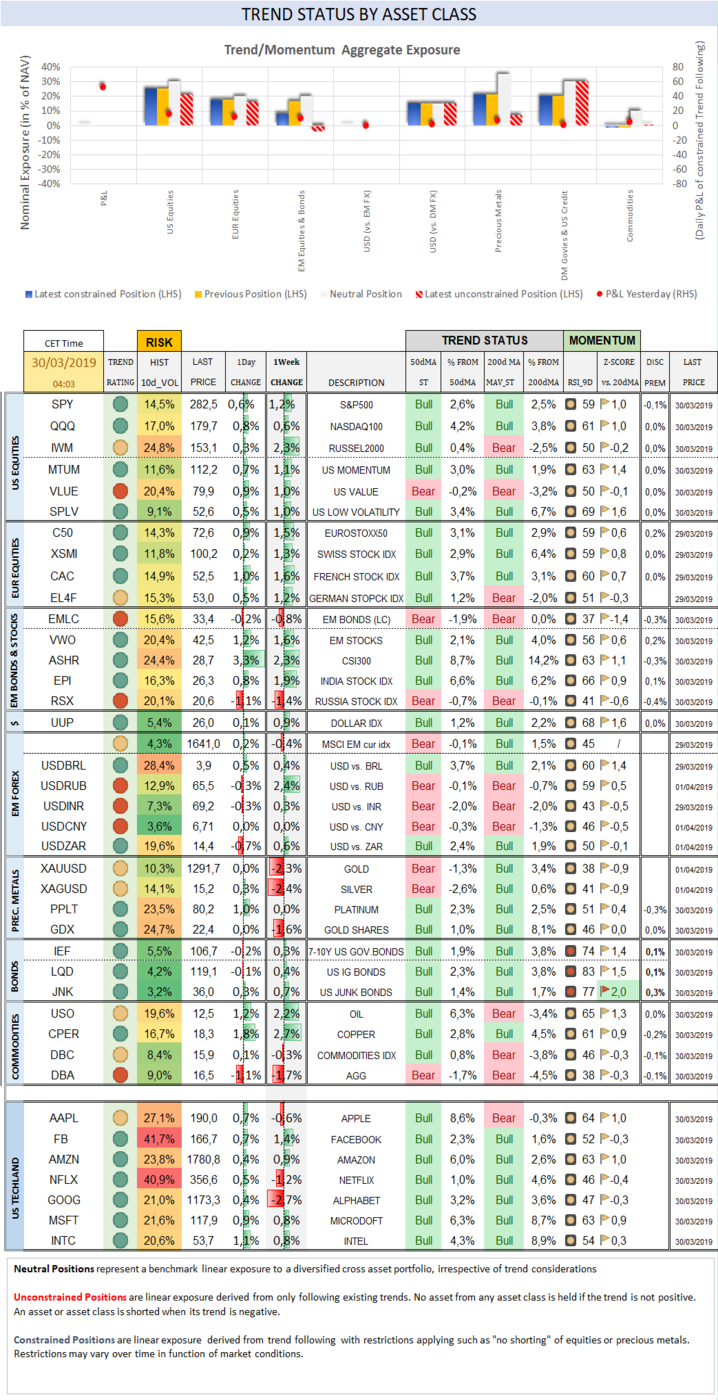

Last quarter turned out to be a contest between “safe haven” sovereign debt and equity markets. While the total return of the S&P 500 remained 2% below its highs, a 60/40 portfolio of equities and Treasuries ended March at an all-time high while a broader multi-asset balanced portfolio returned nearly 8%, its best since 2011. Most of the time, powerful rallies in both government bonds and stocks tend to be negatively correlated. Not this time as the rally was mostly about global central banks’ historic pivot from planned normalisation to stopping to tighten and going back to easing in response to the global economic slowdown and last year’s financial disruptions. All financial assets rallied.

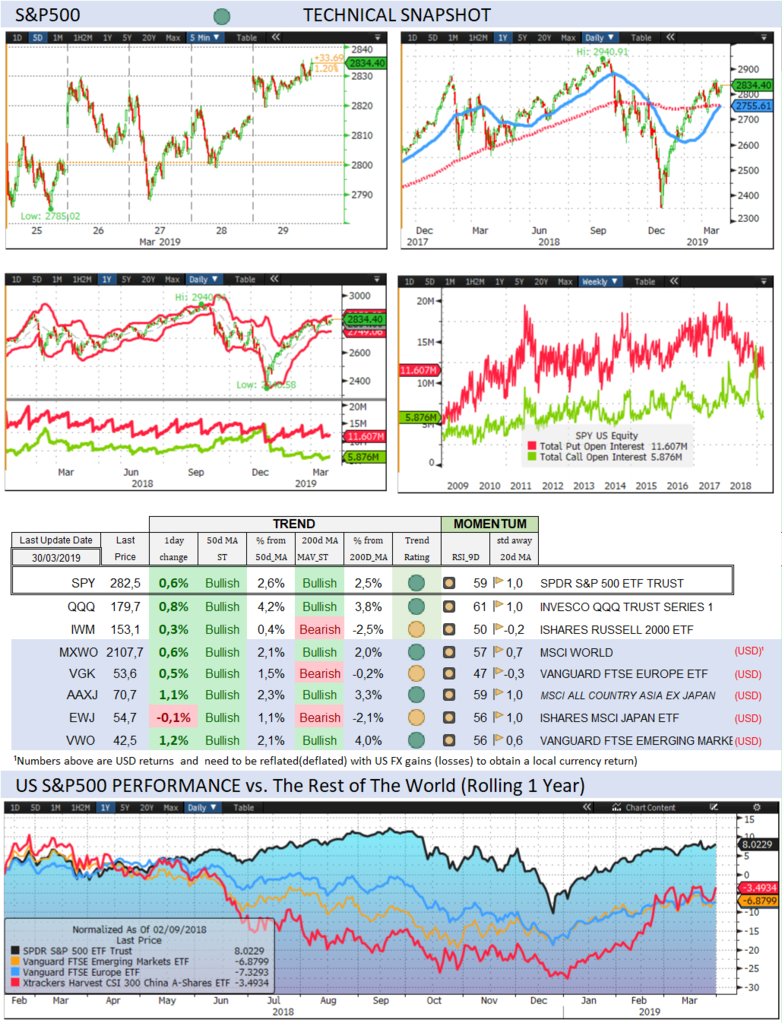

Last week... Over the past week, S&P500 gained 1,2% (13,0% YTD) while the Nasdaq100 gained 0,6% (16,5% YTD) with major indices adding 0.6% on Friday. The US small cap index rallied 2,3% (14,3% YTD). The Eurostoxx50 gained 1,5% (11,2%), out-performing the S&P500 on the week by 0,3%. Diversified EM equities (VWO) gained 1,6% (11,5%), also slightly outperforming US stocks. The Dollar index (UUP) measuring the USD performance vs. other G7 currencies gained 0,9% (2,3%) while the MSCI EM currency index (measuring the performance of EM currencies vs. the USD) dropped -0,4% (1,6%). The apparent UK political chaos after the House of Commons failed to back any of the eight alternatives, including the Withdrawal Bill and for the third time caused some stir but, in the end, will lead to a longer delay and a softer Brexit. Europe conveys that it won’t necessarily support a long delay but ultimately will grant it, we believe. Then GBP might very well gain a little further but the same way we are reluctant to trade EURUSD, we are equally reluctant to trade or express a strong view on GBP. Costs are piling up for the UK economy and new elections are likely coming. 10y US Treasury yields dropped 4bps (-24bps) to 2,44%. 10Y Bunds rallied -6bps (-31bps) to -0,07%. 10Y Italian BTPs dropped 4bps (-25bps) to 2,49%. Credit markets (HY) Average Spread over Treasuries dropped -3bps (-135bps) to 3,91% while US Investment Grade Average OAS climbed 1bps (-38bps) to 1,34%. In European credit markets, EUR 5Y Senior Financial Spread dropped -9bps (-30bps) to 0,80%. EUR 5Y Subordinated Financial Spread dropped -17bps (-63bps) to 1,62%. Gold sold off by -2,3% (0,8%) while Silver dropped -2,4% (-2,2%). Major Gold Mines (GDX) dropped -1,6% (6,3%) while the dollar strengthened and as palladium’s disorderly rally came to a screeching halt, adversely impacting gold. Outside of being a metal, the gold story and history have nothing to do with that of palladium. We’ll expand more on gold in the next few days, explaining in details why we think the selloff will be temporary and why we believe the time has come to hold a larger than usual position in the metal, simultaneously to risky assets that are supported by central banks, while purposely “forgetting” government bonds and being very choosy on corporate debt. The Goldman Sachs Commodities closed the week unchanged (14,1%) but WTI Crude rallied 2,8% (33,1%) and CPER rallied 2,7% (11,4%). These Are No April 1st Jokes... T. May plans to submit her Brexit plan for the 4th time after it was rejected three times already. Mark Zucherberg who tapped and sold our private data (and keeps doing it but now with our own agreement) is calling for more regulation of the internet. "I believe we need a more active role for governements and regulators". He is so funny! Lyft was valued at USD24bn on Friday. Last June it was valued at USD5bn in the latest vc round). The company lost nearly USD1 bn for USD2.1bn turnover. Now they can move on selling Uber at USD120bn because it loses much more money and therefore can be priced at multiples of Lyft. This is no speculative or bubble blowing investing. It is a bet on growth and the future! Value investing will have to wait a little longer...

Why Trend Following Matters and How It Can Help You? The last months of 2018 have shown how hard and fast markets can fall. Trend following offers guidance as to when to get in and when to get out of an asset class with changing trend characteristics. A disciplined and rule-based trend following investment approach can serve as an effective portfolio insurance technique. Our purpose, beyond tracking economic, political and monetary developments is to assist readers investing in global markets with a view on trend formation in all important sectors. To receive our daily updates and market reviews, consider our premium research: https://www.bentinpartners.ch/research And join our free trial. https://www.bentinpartners.ch/subscribe Important Disclaimer © Copyright by BentinPartner llc. This communication is provided for information purposes only and for the recipient's sole use. Please do not forward it without prior authorization. It is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This report does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this Report may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This Report is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the Report. #fx #forex #investing #markets #riskmanagement #bankingindustry #finances #money #traders #quants

Comments