What Inflation Expectations Are Telling us...

- Marc Bentin

- Feb 1, 2018

- 2 min read

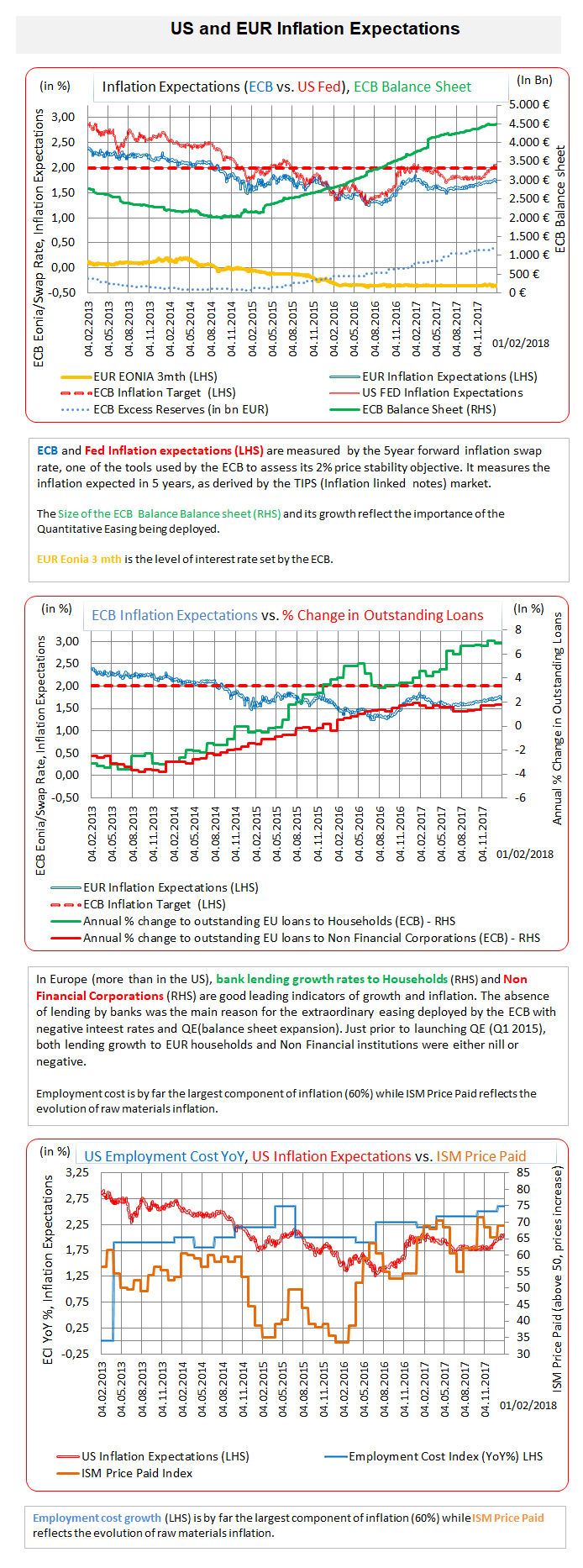

Not much except that US inflation expectations are right there at 2% and EUR inflation expectations at 1.75% with both heading higher, enough for Fed officials to start talking about introducing some flexibility in its already soft target and for the ECB to start talking about taking the foot off the metal as the 2% (for them so far a hard limit) target approaches...of course these are only inflation expectations from the tips market but unless we say those expectations are wrong, they clearly show that the deflation scare is gone and to be replaced by something else...that is what the bond market tries to tell us at least. As regards Europe, bank lending to household (green line) was the problem and has been resolved. Salary wages are not going to be a “problem” anywhere, courtesy to the uberisation and robotisation of society (Switzerland is rightfully in my mind talking about taxing them) but commodity strength and perhaps more acutely dollar weakness deserve a watch as a threat to the inflation outlook, in our view.

For a daily update and interpretation of these different parameters and much more, consider a subscription to the Bentin Daily, our premium research service. Important Disclaimer © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog.

Comments