Daily Close

- Marc Bentin

- Mar 1, 2018

- 4 min read

February was a short month but one that will be remembered for delivering an unprecedented volatility blow and a cross asset underperformance that will leave marks (and likely scars). There were simply no place to hide in February and unless you were invested in soybeans or Finnish stocks for some reasons, there was nowhere to hide last month. We were lucky or fortunate enough to advise readers of our investment letter early last month to seek protection when Ray Dalio (the manager of he largest hedge fund in the world) suggested in Davos that we might end up being one of these idiots looking at the market going up in the goldilock period, running the risk to miss the blow off phase while it was clear to us (and probably to this astute investor as well) that the blow off phase had just happened in January... which made the whole statement in Davos suspicious to us, alerting our contrarian trading DNA. Now, we did run for cover and saved some money but this selloff was not the most or the only ‘salient’ (to borrow the name of the index tracking risk parity funds such as Ray Dalio’s All Weather fund targeting risk adjusted investments across asset classes) event of the month. The speed of the subsequent recovery from a 10% swoon and volatility funds’ blowup was epic as well and one of the quickest in history (which we flagged as super or un-natural). This recovery brought some credence to the idea that it is always better to ride out corrections... Until Tuesday that is (for now)...because what we witnessed over the past two days was a relapse into weakness after an epic squeeze that followed an epic selloff... This “wax on wax off” trading pattern may have shed further blood on the street....among risk parity funds, cta’s (mostly systematic futures traders playing trending conditions up and down) and hedge funds in general. We will find soon enough.

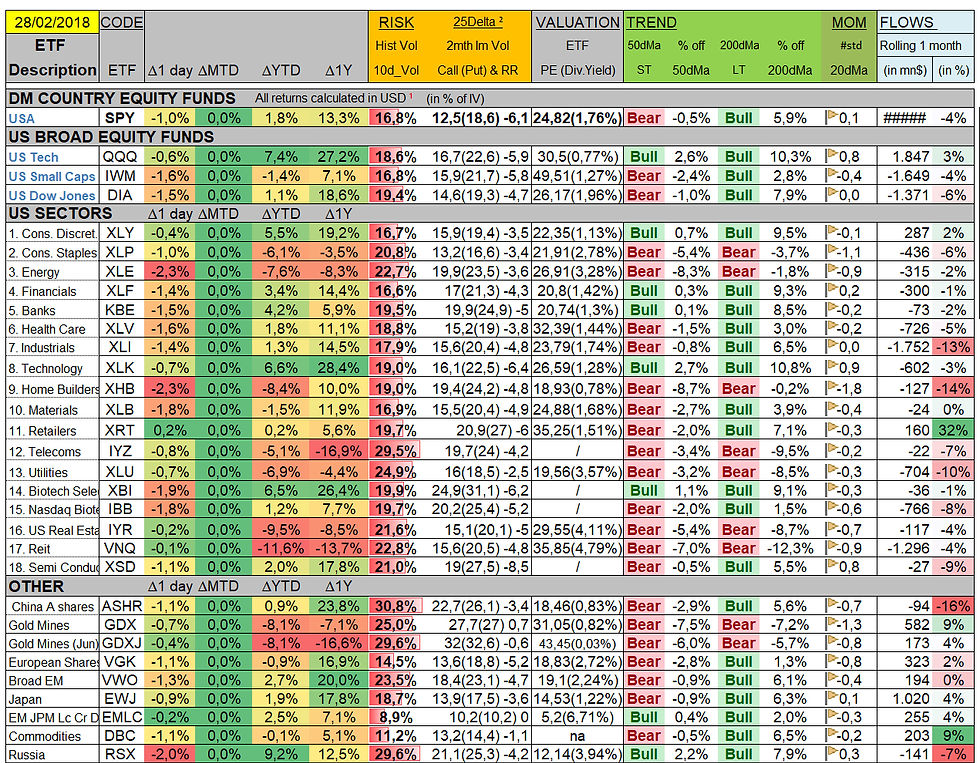

The S&P500 dropped 1% yesterday with small caps and the dow shedding 1.5%. Most sectors fell back below their 50dMa. Fed Chair Powel will appear in front of Congress again today and it will be interesting to see if he comes out as hawkish as Tuesday (with four rate hikes expectations). All assets fell again yesterday with the only difference coming from how much each of them lost. This spells deleveraging to us and more pain ahead. A gap back up is also possible, natural or super natural, but one thing seems sure. Volatility is back. At least we think so... and we bought back long term volatility as we do not think it makes lasting sense to see long term volatility( >9 months) lower on Monday than it was at beginning of the year... with a a large source of volatility selling blown up in the air (vix funds). A higher structural volatility is therefore likely and volatility curves probably ought to adjust accordingly, across asset classes as well, in our view.

BentinPartner Advisers, Basel There is more to our research than the Daily Close, the Confidometer and our blog posts. To receive actionable content, a comprehensive wrap up every day and our tactical FX and global models positioning or if you wish to be notified 24/7 with updates on key macro economic releases and/or technical breaches on our comprehensive investment universe covering international equities, bonds, FX, precious metals and commodities, take a free trial to the Bentin Daily, our premium research service. We help you know when to run and when to sit by tracking all developing (or well established) trends and equally importantly by flagging market breakouts. You may join our free trial by clicking here. https://www.bentinpartners.ch/subscribe We are leaving no stone unturned. Important Disclaimer © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog.

Comments