Confidometer Review

- Marc Bentin

- May 26, 2018

- 4 min read

Our Confidometer assesses global risk conditions using a mixture of sentiment, option prices, investment flows and margin debt data to help determine if investor sentiment is excessive or not (thereby raising a green or red flag). Our analysis focussed primarily on the S&P500 which serves as the bellwether equity index for most investors.

For a daily update of these indicators and much more with commentaries and actionable content, consider a free trial to the Bentin Daily, our premium research service. For a brief daily review, check our regular blog posts.

Today’s confidence report is slightly longer than it should be.

Confidence remains largely “neutral” with the notable exception of the “smart money indicator” printing fresh lows, meaning investors continue to buy at the open and to sell towards the close which reflects a general lack of investors’ confidence (which of course could be read positively as well). Volatility remains extremely low with investors showing no interest for protective option purchases, reflecting a lack of near term concern for equity markets.

Investors have indeed nowhere to go but to the “broad” stock market, making sure they do not depart too much from a high diversification rigour. Bonds (except up to 2 year bonds when they yield anything) are a no-go except as a short term trading hedge (bunds to hedge btps for ex.) and because they are a safer way (short term ones) to park zero yielding cash than with time deposits exposed to the potential pitfalls of the ‘bail in’ discipline that will apply during the next global crisis (if or when it strikes).

Besides those considerations, bonds hold little to no value and will “detract” from performance when the bond bear finally strikes after 30year+ of a bull trend that suppressed most of the expected long term returns for bonds. As the same time as economic indicators (economic surprise index, PMI’s, LEI’s) are mostly pointing downwards, the fact that inflation is creeping higher with central banks currently pulling out (fed, snb) or likely to pull pull out (ecb, Japan) from extraordinary QE purchases can only spell bad news for global liquidity even if the worry is not for this or next week. The time prepare might be now.

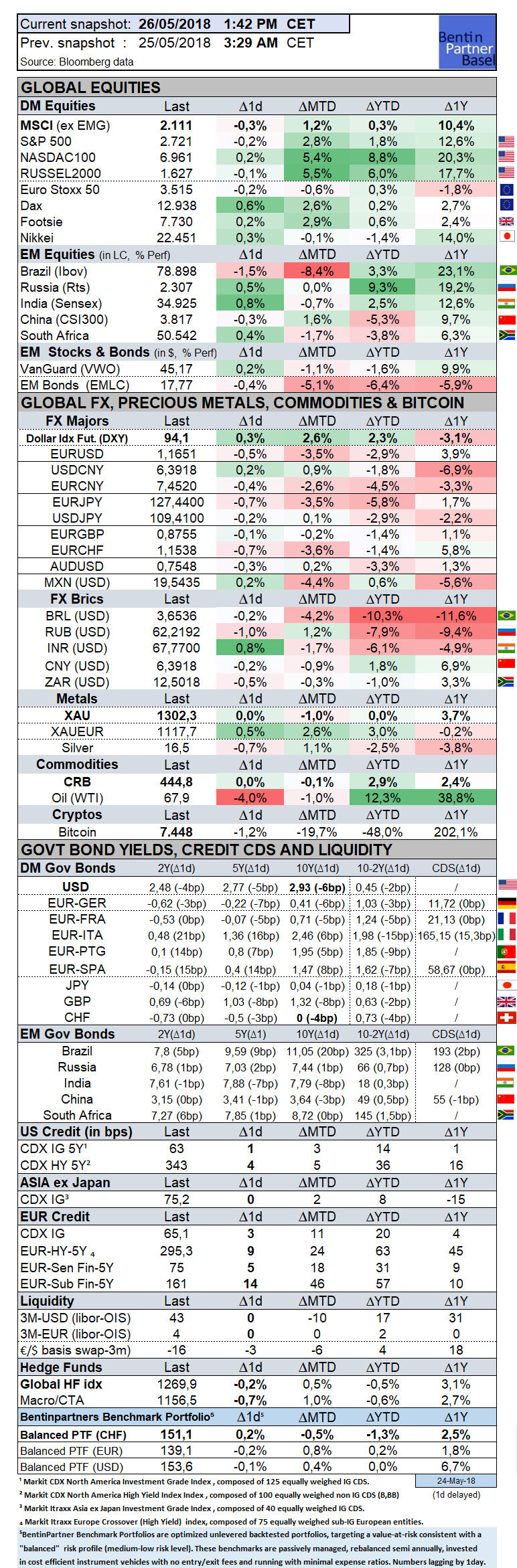

Credit markets are showing signs of cracks (with a notable underperformance of HY last week and so far this year, see performance snapshot below). EM markets have notably underperformed this year.

With so many asset classes a no go, DM stocks, unless broad equity indices start to fall, will remain natural magnets (and act as a cork put under water, only floating but also capable of popping) for investors. Still, returns so far this year have been mostly negative, flat or insignificantly higher for the year across segments with the only exception being the tech sector, up 9% ytd. Volatility in FX is slowly starting to creep higher and not only in EM. The dollar might continue to rally for ‘plumbing reasons’. The crypto craze (bitcoin down 50% this year, 20% this month) is over with the regulatory backlash likely to further obliterate this asset class. Banks (as an equity sector) are not doing great which is another negative. Real estate is weakening as well.

The structure of the market today, in our view, reflects a total lack of (prospective) liquidity (made worse by sharebuybacks in some cases) in all but the most liquid market segments, corporate, high yield and most equity segments included. When liquidity will be needed, all robots holding markets will pull out at the same time, leaving investors with a black hole of illiquity and flash crashes becoming the norm rather than the exception. This will be the price to pay for letting capital and human resources be replaced by speed (calculated in nanoseconds) and (the only artificial intelligence of) robots. This is why, with all due consideration to upside risks, we would remain long volatility with protective long term puts and of course (despite all the frustration and manipulation that this asset class may have brought over the years) gold (in physical form) held as natural hedge against possible market disruptions.

Important Disclaimer © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog.

#DollarIndex @federalreserve #ForexMarket #ForexNews #USD #USTreasuries #TradeWars #Markets

Comments