Minding Our Step...

- Marc Bentin

- Oct 23, 2018

- 3 min read

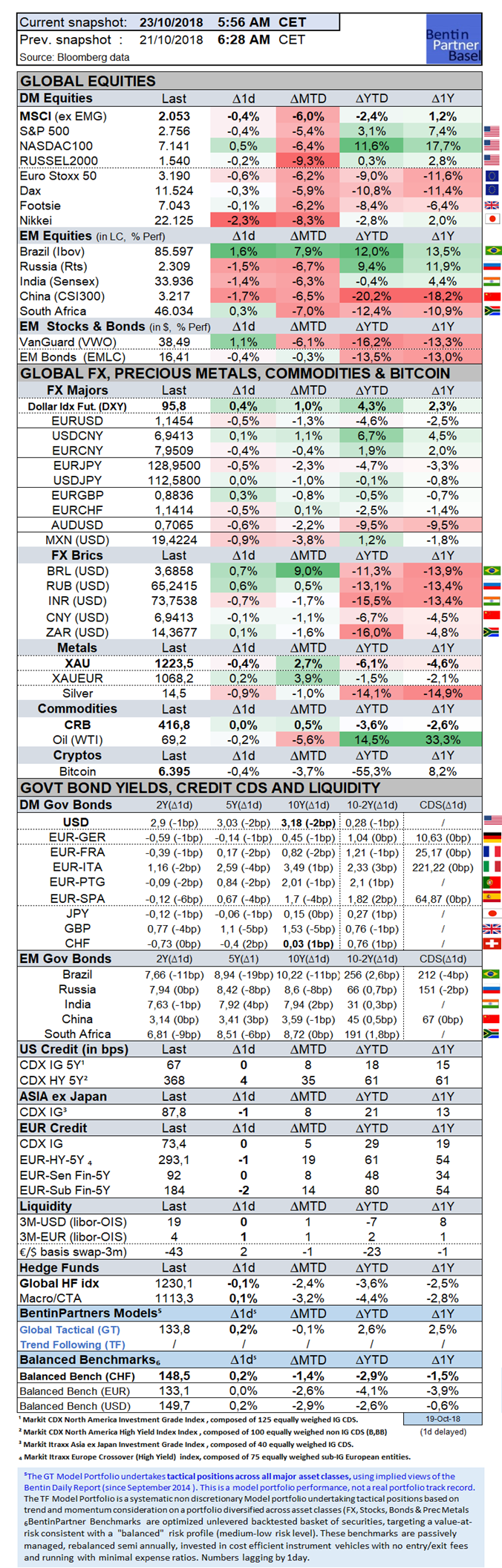

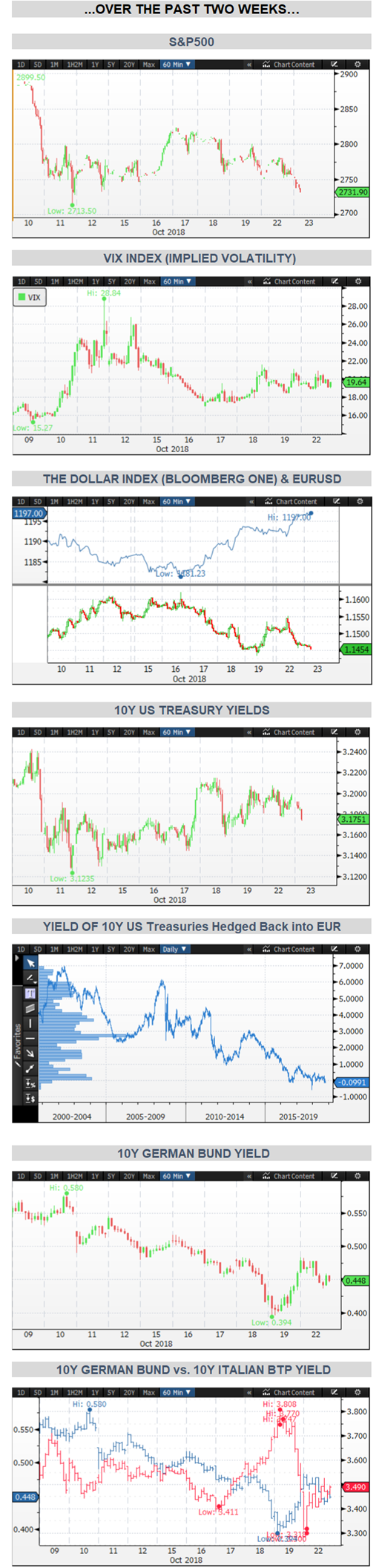

US stocks started overnight on Sunday, jolted by the verbal intervention of Chinese authorities aimed at propping up ailing Chinese equities. They rose by 4% overnight on Monday. However, this rally did not hold with weakness ensuing in European Equity markets with follow through selling in US hours. The S&P closed -0.4% (below its 200dma by as much) although the Nasdaq fared better eking out a +0.5% gain ahead of Alphabet and Amazon earnings report. The small caps index dropped -0.2%. Pot stocks that have taken Wall Street by storm had their worst session on record on high volume. Tech stocks and even momentum shares tried to make a (false in our view) impression yesterday. Construction shares dropped another -3-3% yesterday (-16.3% MTD, -35.5% YTD). We saw the damage inflicted to EM and European markets this year and over the past month. We see the kind of dead cat bounces (another expression of the collapse in the so-called smart money indicator) that we get on the S&P (we had three days in a row the market closing with a reversal of an earlier day’s strength). More ominously still, bank shares in Europe and elsewhere remained weak (shedding -2.1% yesterday) and we are at pain to spot pockets of strength or resistance. Bank stocks are at their lowest level for a year; they are exiting their Bollinger bands on the downside. This is what we saw in early 2007 and it was the canary in the coal mine...at the time. Precious Metals dropped slightly, only taking their cues from the dollar strength (vs. DM) but remained on the healing path, en route for its own 200dMa. Japan’s biggest bullion retailer said sales of gold bars climbed 52% y/y in the first nine months of 2018 as falling prices fueled demand, Bloomberg reported. ————- This is a delayed and abbreviated version of our premium subscription-based report sent by email to our subscribers every day prior to Asian Markets Closing by 5AM CET time. For a timely and detailed update on global markets, a comprehensive suite of market reports and a briefing of our tactical model portfolios positioning, consider our premium research. Discounts may apply for all private (USD500/year) and professional (USD2’000/year) subscription plans. We help you know when to run and when to sit by tracking all established or developing trends on all major asset classes and by flagging all statistically meaningful market breakouts or trend breaches. To join our 2 weeks free trial, simply click the link below. You won’t regret it! https://www.bentinpartners.ch/subscribe ————- Important Disclaimer: © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog. #DollarIndex @federalreserve #ForexMarket #ForexNews #USD #USTreasuries #TradeWars #Markets

Comments