Daily Close

- Marc Bentin

- Jun 25, 2018

- 3 min read

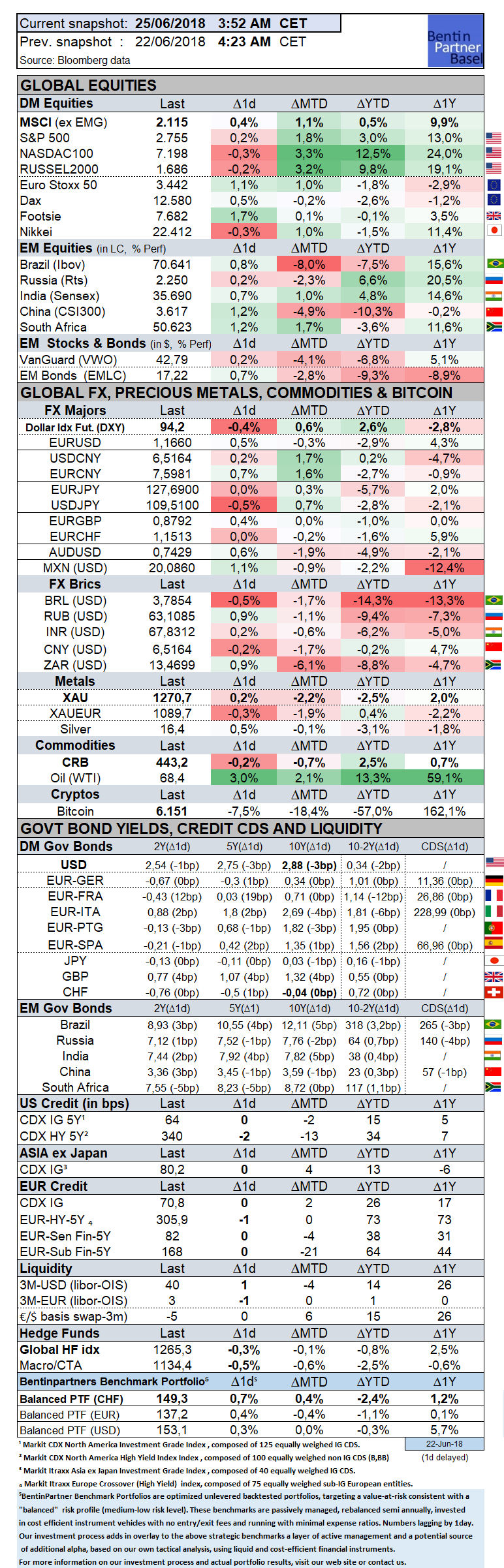

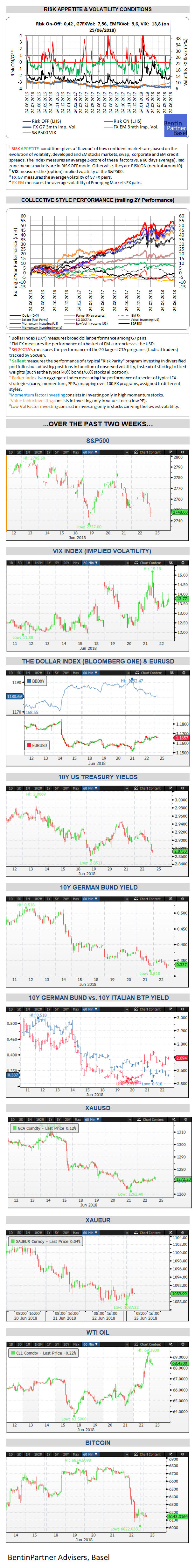

US Stocks finished slightly lower on Friday but in a way that could herald some more downside this week with tech and momentum stocks performing the worst and above all closing on a little rush to the downside in the last minutes which left confidence shaky. Eurostocks gained +1.1%, outperforming as did EM stocks, FX and local debt markets. The tape and EM were saved by a rally in the oil sector on Friday on the prospect of an OPEC oil deal and a 3% gain in oil prices but still closed sharply lower on the week. Besides this pocket of strength on Friday, there was not much positive to report from the Trump tweeter feed over the week end either. Not only has D. Trump started to speak like Julius Caesar saying the “United States wants this and the United States wants that…”, as he tweets his opinion, not necessarily shared by the majority of Americans or Congress for that matter, but there was no sign of appeasement on the trade front from his Tweeter freed with the scenario of tit for tat responses to his increasing aggressivity stance becoming all the more likely now. “The Treasury Department is planning to heighten scrutiny of Chinese investments in sensitive U.S. industries under an emergency law, putting Washington’s trade war with Beijing on a potentially irreversible course”, Bloomberg commented. As we noted last Friday, we are de-risking and continue to do so this morning. The economic surprise index for most economic areas is sending some dire signals. For sure, the US economy is bucking the trend for now and is keeping some bulls excited and perhaps overconfident about recent late cycle earnings reports but the US curve keeps moving towards inversion which remains a reliable indicator of recession as well. Cross asset correlation is sending warning signals as does EM FX volatility. Our risk aversion/appetite indicator has now turned red into risk aversion territory as well.

This is an abbreviated version of our premium subscription based report published ahead of the US and European session every day. For a timely and up to date detailed global markets commentary, a comprehensive suite of market reports with global tactical model portfolios and daily insight, join a free free trial to our premium research or contact us. Discounts may apply for both private and professional subscription plans.

Important Disclaimer © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog. #DollarIndex @federalreserve #ForexMarket #ForexNews #USD #USTreasuries #TradeWars #Markets

Comments