Manipulator In Chief

- Marc Bentin

- Nov 15, 2018

- 5 min read

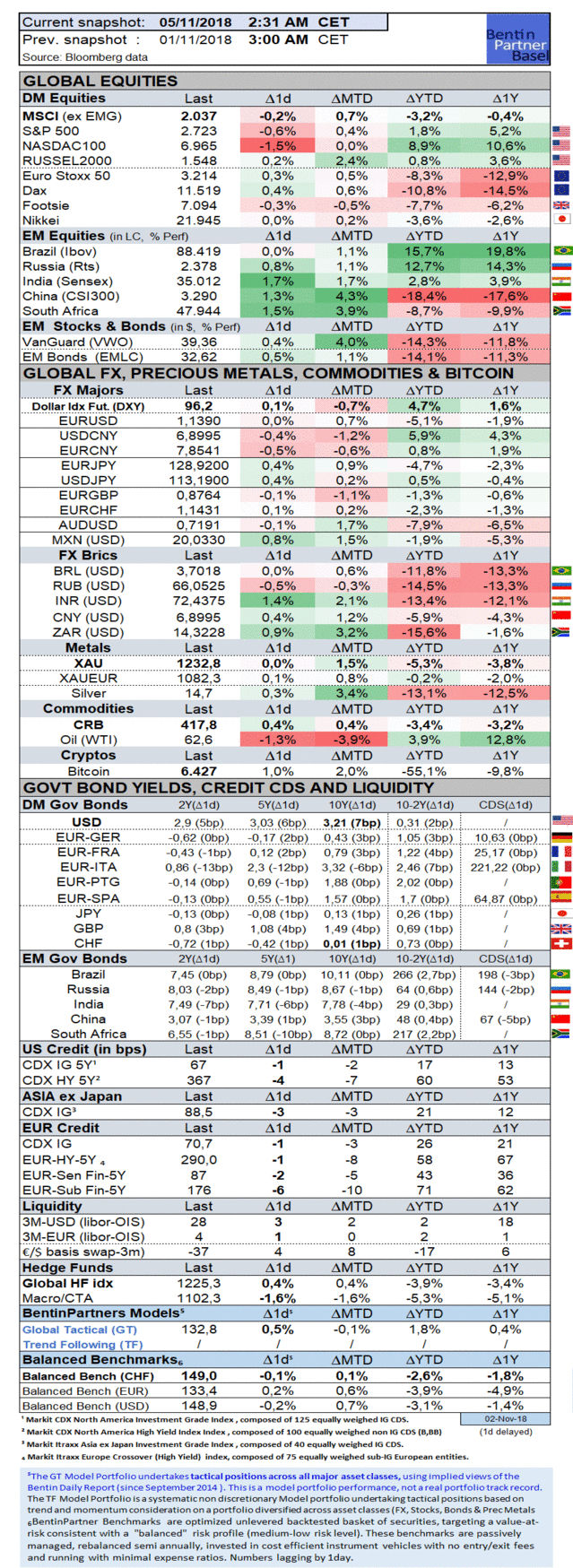

US stocks (sector performance) dropped with weakness most pronounced in the tech sector as the Nasdaq dropped -1.4% and the S&P -0.7% on fear that US stocks might be losing an important pillar of support and following a strong job report which only reassured the Fed to stay on track of its rate normalization policy. The bad news came from AAPL which dropped 7% despite a strong Q3 earnings report as the company issued a tepid guidance for Q4 and as market participants were left wondering Apple decided to stop providing the breakdown of its sales by product in the future. The official line was a change in communication aimed at getting the market to focus on its services performance (and cloud related services…again…like IBM) instead of its iPhone or hardware sales. That might be fine ultimately but it was also seen as a near term problem for a company currently drawing 90% of its profits from iPhone sales which have benefited for the current quarter from a USD175 average selling price (that strategy of raising prices to offset a lack of growth will have to stop sometimes) but suffered in terms of future expectations from a meager growth of 0.4% in sales. The AAPL success story also convinced investors on the argument that it was a growth story but Friday’s report confirmed this might be a feature of the past as regards iPhone sales. So goes Apple so goes the market, investors like to say. Friday was no different and the 7% decline in AAPL shaved most indices, including the S&P which shed 30 points before D. Trump tweeted the market out of this bottom for the day, airing his confidence that an agreement with China might be forthcoming. The impact of Apple on Tech was significant on Friday causing a 2% decline in the largest tech ETF (XLK) which carries a 20% weighting on the stock, more than any active manager would dare to have on a single share in a single fund. From saving grace to potentially pariah (many of the Fangs have witnessed air pockets of their own leaving them in bear trends), XLK now trades -5.9% below its 50dMA and 2% below its 200dma). Home builders were the second weakest sector on Friday on fear of higher rates while banks fared comparatively much better for the same reason. While this was mostly a bond story, the US job report came in stronger than expected on (+250k Non-farm payrolls vs. 200k expected with wage compensation rising to +3.1% and unemployment staying stable at 2.7%) likely steadied the Fed’s course towards more normalization. GE dropped another 3% (-50% YTD) revisiting its 2009 lows, after slashing its dividend by 92% earlier last week. GE also dropped from the commercial paper, the FT reported. Déjà vu? Despite all this, EM markets (Diversified EM EMLC China CSI300 Russia) rallied, led by China as the Central Bank introduced supportive measures and with D. Trump coming to the rescue tweeting that an agreement might be found with China that would avoid the worst of a trade war. EM currencies were mostly stronger as well. (USDBRL USDINR USDRUB USDCNH USDZAR USDARS USDTRY) . European markets outperformed. Elsewhere in currencies, not much of substance came from the COT report which showed a further (but small) increase in the net EUR shorts (to -32.7k from -30.2k) and a steady large speculative JPY net short of (-92.6k). The speculative MXN longs was paired back to +33.8k, registering a 24.2k decline. Considering the strength of the US job report, the USD performance remained underwhelming something that Goldman observed this week end in a note, as the US remains confronted with the promised challenge of having to fund an extraordinary supplementary fiscal easing. US 10y Treasury yield climbed +7bps (bond yields snapshot) while 10y German Bund yield climbed +3bps (to +0.43%). BTP Yield climbed +7bps. Fixed income elements occupied 11 of the 12 last spots in our Z-score report (between -2.5 and -3) while Nat gas and platinum occupied the top 2 spots (+3). Gold was stable and silver outperformed (+1.5%). US High Yield Credit spreads were stable on Friday after their recent deterioration (HYG). Oil dropped 0.5% despite Iranian sanctions coming into effect (with notable exceptions) this morning. Friday’s Commitment of Traders report (COT) showed a further decline in the net oil position in crude oil to 400k (furthering a decline from the highs seen at +800k in May). There was a noticeable difference between oil and gas with the latter gaining 5% to reach the top of our Z-score report, well above the upper range of its Bollinger band. For what it is worth, US oil production increased so far this year by 1.5mn bd (OPEC by a little less than 1mn), essentially grabbing the loss in market share of …Venezuela which over the same period bowed under US sanctions as well. The US President’s decision to authorize exemptions to China, India and 6 other countries reflects some pragmatism (what choice does he have to impose a ban on China, India or Russia and even on Turkey which has got very close ties with Iran) showed the hypocrisy of the US policy which will only restrict Europe in its dealings with Iran, while also forcing the hand of Swift (an habit pursued systematically by the US administration on the targets of its sanction regime) taking Iran off line an important payment system as it wages an economic war against this country.

————- This is a delayed and abbreviated version of our premium subscription-based report sent by email to our subscribers every day prior to Asian Markets Closing by 5AM CET time. For a timely and detailed update on global markets, a comprehensive suite of market reports and a briefing of our tactical model portfolios positioning, consider our premium research. Discounts may apply for all private (USD500/year) and professional (USD2’000/year) subscription plans. We help you know when to run and when to sit by tracking all established or developing trends on all major asset classes and by flagging all statistically meaningful market breakouts or trend breaches. To join our 2 weeks free trial, simply click the link below. You won’t regret it! https://www.bentinpartners.ch/subscribe ————- Important Disclaimer: © Copyright by BentinPartner llc. This blog is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This blog does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this blog may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This blog is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the blog. #DollarIndex @federalreserve #ForexMarket #ForexNews #USD #USTreasuries #TradeWars #Markets

Comments