Weekly Trend Status Update

- Marc Bentin

- Aug 19, 2019

- 6 min read

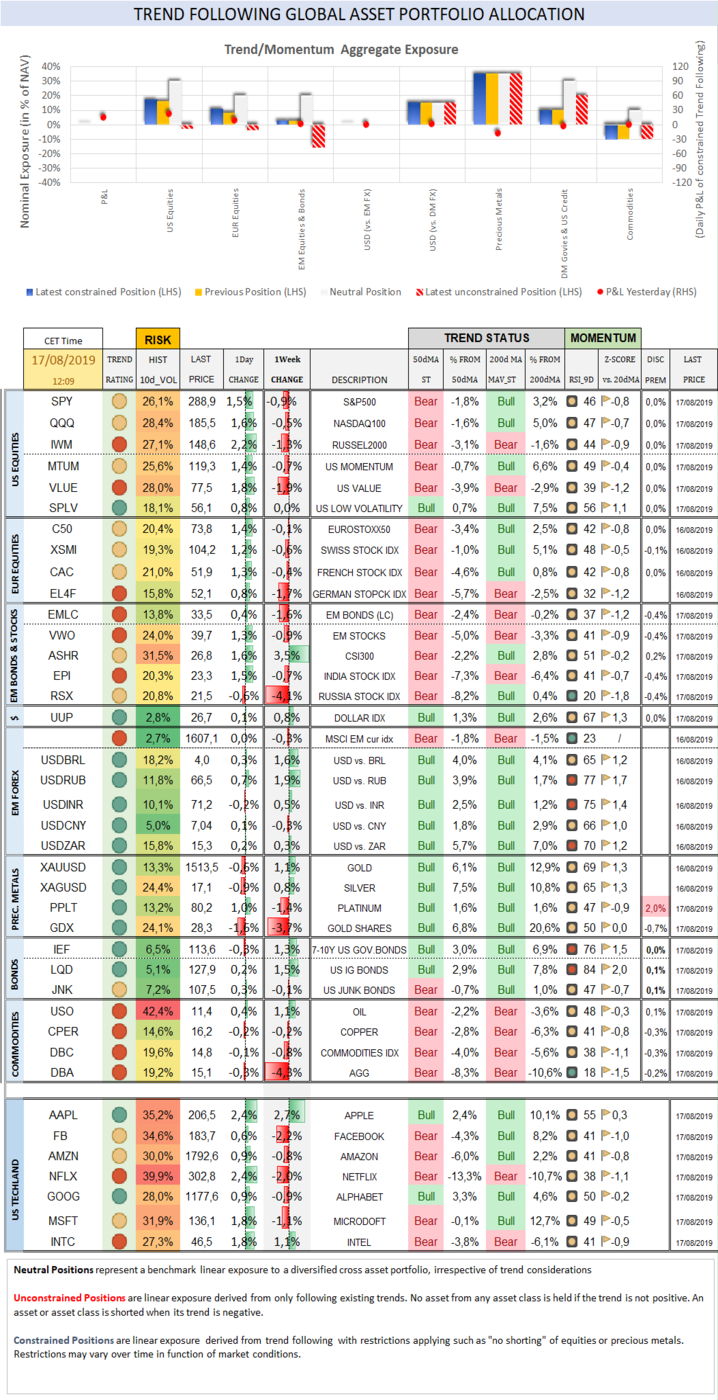

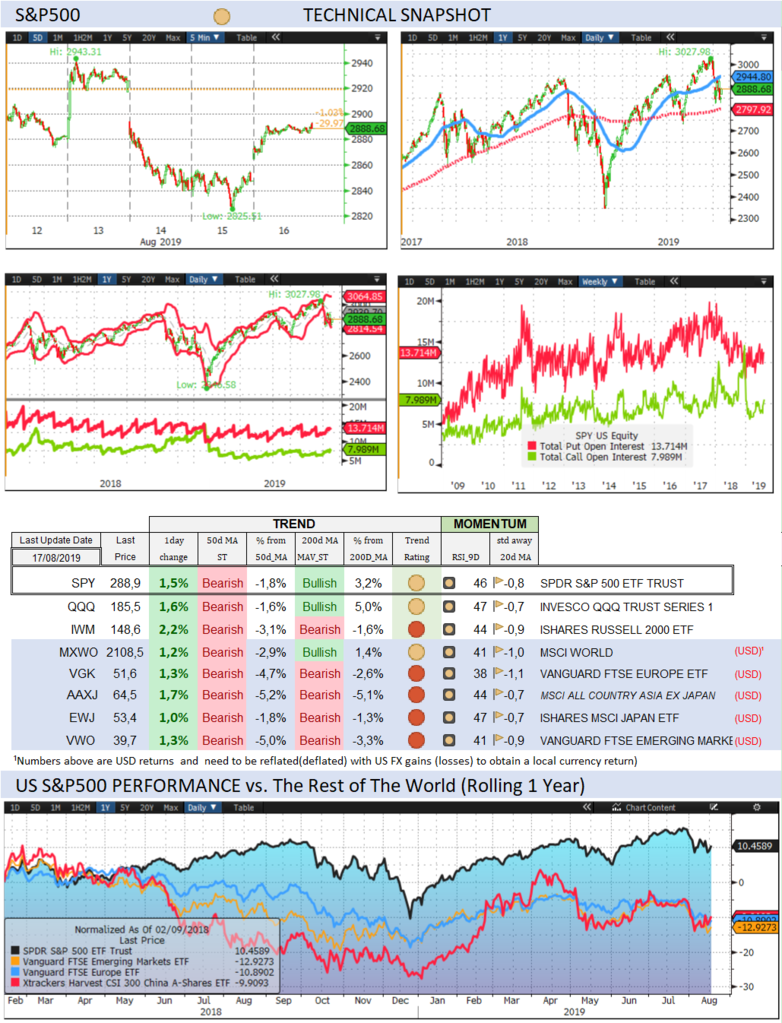

Over the past week, financial markets faced three or four sources of unrest which laced together, led to some nerve wrecking sessions including a 3%+ loss on Wednesday for major US indices. Social unrest in HK, a meltdown in the currency and financial assets in Argentina, coupled to hard evidence that the global economy is stalling sent shock waves down the spine of financial markets last week even as the final score card for stocks remained unimpressive, contrasting with global bond markets which were nothing short of impressive (10Y yields dropped to -37bps in Belgium, -26bps in Slovenia, -18bps in Latvia while Italian yields wiped out political concerns shedding -40bps). The 2/10 US treasury spread also went negative. This indicator can be read as the sign that central banks are about to unleash massive monetary easing (many of them have actually started front running the Fed and the ECB (O. Rehn) just confirmed it will deliver in September) but this curve inversion has more importantly passed the test of time as a sure bet for an approaching recession. Seeing the German ZEW drop to the worst level since the 2007 global crisis with German exports declining -8% year over year and those in South Korea dropping by an even larger -11% was bad enough. Seeing US capex going nowhere and now restaurant and clothing retail spending start to decline brings more evidence that the locomotive of the US economy (consumer spending) could be facing some serious headwinds as well. We are not saying this lightly but now is the time where we believe that unsound nature of money will start having consequences on the way money is being managed. We actively prepare to completely scrap cash and bond markets from the asset allocation of our portfolios. “Cash” is about to turn to “thrash” and about 15trn worth of bonds yielding negatively are there already. It does not matter to us (and we have managed multibillion-dollar portfolios in our professional career and appreciate there might be some juice left in them, especially in Treasuries) whether Bunds go to yield -3% as some serious analysts now believe. Nestle shares (and their 2.25% dividend) also remain close to our heart and equity portfolios but we would never consider their bonds yielding negatively. Nobody should ever be allowed to borrow for free whether one’s credit risk assessment is pristine or poor unless we agree to turn capitalism over to its head (exemplified by cash borrowing for share buyback purposes which pushed to the limit will lead to a delisting of sound corporate America). We find it particularly shocking and reflective of a profound malaise (and inefficiency of policies being globally pursued) that real estate agents can borrow at negative rates to fuel an ever-inflating real estate bubble while credit card debt is charged an 18% annual cost. Judging from that angle, reducing rates to where they are (and where they go) has been (and will be) self-defeating and we do not blame central banks for it. They have few other choices than to respond to the paralysing unpredictability of one man by preparing the ground for the next phase of debt monetisation and fiscal stimulus. We stand ready to bunker down and forget bonds (and credit) in the US, Europe and many parts of Asia, probably for years (decades) to come because we do not see how central banks will be able to take their foot off the metal of the pedal for a very long time. The next steps beyond the Fed bringing rates to zero by the end of the year will be for QE to return and for MMT to take hold, in our view. The room for cash as an investment should therefore be limited in this context to selected EM currencies. Cash has got one virtue however; that of liquidity of which there is always a risk that it might disappear…but as an investment, it is moribund, in the developed world at least. The rest of the investment universe, namely stocks (we do not see how they could be allowed to fall meaningfully and as a result we expect multiples to expand even as an earnings recession takes hold), real assets (real estate), commodities, precious metals and selective forms of alternative investments (private equity) should remain fine. It does not matter whether D. Trump’s bluff is slowly being called by the Chinese (and others). He is right about China in many ways but the way he has alienated the world will bear serious consequences, economically, geopolitically and financially. The damage is there to take hold and the payback time is fast approaching unless he takes a 180degree turn in policies and attitude which we doubt his brilliant self-proclaimed intellect is capable of conceding. Over the past week, the S&P500 dropped -0,9% (15,6% YTD) while the Nasdaq100 dropped -0,5% (20,2% YTD). The US small cap index dropped -1,3% (11,0% YTD). CBOE Volatility Index added just 2,8% (-27,3% YTD) to 18,47, reflecting only slightly the few sweaty sessions endured last week. The Eurostoxx50 dropped -0,1% (13,0%), outperforming the S&P500 by 0,8%. Diversified EM equities (VWO) dropped -0,9% (4,3%), matching the S&P500. The Dollar DXY Index (UUP) measuring the USD performance vs. other G7 currencies gained 0,8% (4,8%) while EURUSD dropped -1,0% (-3,3%). The MSCI EM currency index (measuring the performance of EM currencies vs. the USD) dropped -0,3% (-0,5%). USDBRL gained 1,6% (3,2%). USDRUB gained 1,9% (-4,1%). USDMXN gained 1,3% (0,0%). Elsewhere in FX, EURGBP dropped -2,0% (1,6%), supported by UK numbers on wage growth, jobs and consumer spending even as its business sector suffers from Brexit uncertainty, leading to GBP short covering (including ours) last week. EURCHF dropped -0,4% (-3,6%) as risk aversion prevailed. 10Y US Treasuries rallied -19bps (-113bps) to 1,55% on accelerating rate cut expectations. 10Y Bunds dropped -11bps (-93bps) to -0,69%. 10Y Italian BTPs rallied -41bps (-135bps) to 1,40%, recovering most of the previous week’s underperformance related to the political situation in Italy. US High Yield (HY) Average Spread over Treasuries climbed 22bps (-89bps) to 4,37%. US Investment Grade Average OAS climbed 4bps (-35bps) to 1,37%. In European credit markets, EUR 5Y Senior Financial Spread dropped -3bps (-42bps) to 0,68%. Gold gained 1,1% (18,0%), SPROTT PHYSICAL GOLD TRUST gained 1,2% (17,9%) while Silver gained 0,8% (10,4%). SPROTT PHYSICAL SILVER TRUST gained 1,6% (14,0%). Major Gold Mines (GDX) sold off by -3,7% (34,1%). Goldman Sachs Commodity Index dropped -0,8% (4,5%). WTI Crude gained 0,7% (20,8%).

———- To receive our daily updates and market reviews, consider our premium research: https://www.bentinpartners.ch/research And join our free trial. https://www.bentinpartners.ch/subscribe Important Disclaimer © Copyright by BentinPartner llc. This communication is provided for information purposes only and for the recipient's sole use. Please do not forward it without prior authorization. It is not intended as a recommendation, an offer or solicitation for the purchase or sale of any security or underlying asset referenced herein or investment advice. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situation, investment horizon and particular needs. This report does not include information tailored to any particular investor. It has been prepared without any regard to the specific investment objectives, financial situation or particular needs of any person who receives this report. Accordingly, the opinions discussed in this Report may not be suitable for all investors. You should not consider any of the content in this report as legal, tax or financial advice. The data and analysis contained herein are provided "as is" and without warranty of any kind. BentinPartner llc, its employees, or any third party shall not have any liability for any loss sustained by anyone who has relied on the information contained in any publication published by BentinPartner llc. The content and views expressed in this report represents the opinions of Marc Bentin and should not be construed as guarantee of performance with respect to any referenced sector. We remind you that past performance is not necessarily indicative of future results. Although BentinPartner llc believes the information and content included in this report have been obtained from sources considered reliable, no representation or warranty, express or implied, is provided in relation to the accuracy, completeness or reliability of such information. This Report is also not intended to be a complete statement or summary of the industries, markets or developments referred to in the Report. #fx #forex #investing #markets #riskmanagement #bankingindustry #finances #money #traders #quants

Comments